No Clear Nor Close Target

Price stability and a positive rate of inflation should not be the aims of a monetary authority, as such policies tend to create severe financial instability. Prices should fluctuate to reflect the productivity of individual industries and the economy as a whole, and the efficient (or inefficient) allocation of resources.

The Problems and Failures of Inflation Targeting and Price Stability

“Insanity is doing the same thing over and over again and expecting different results”, is the famous quote usually attributed to Albert Einstein; a parable of quantum insanity, but such a quote could equally be a parable of inflation.

With the Bank of England and the Federal Reserve seeking to maintain its target rate of 2%, and the UK inflation rate merely falling to 10.7% from 11.1%; still an exceptional high, it may be time to acknowledge the problems of an inflation target.

Inflation targeting as a monetary policy in the UK first began in 1992, with the goal of maintaining a predicted level of inflation for future economic planning; being able to take account of a persistent rate of inflation, and to maintain price stability.

There are, however, many troubles with an inflation target.

It is important first; in order to fully understand the problems with inflation targeting, to define inflation separate from the common definition. The common definition of inflation is a general increase in the price level, however this definition provides a great deal of confusion with regards to the cause of inflation, as this definition conflates the cause and effect.

Inflation is and always an excess increase in the money supply (M S) over the quantity demanded (M D), leading to a depreciation in the purchasing power (real value) of money.

This is the definition which most accurately depicts the cause of inflation, whereby the effect of an inflationary policy is a general increase in prices; though all prices will not rise to the same degree, as people demand differing goods at different quantities and timeframes, and some goods are more inelastic than others.

To define inflation under the common classification is to ignore that the general price level may change due to a shortage in some good used in multiple production periods and processes. As professor Cachanosky states:

“defining inflation by describing a movement of a variable that can have multiple reasons invites confusion. This confusion can eventually lead to errors in monetary policy.” (Cachanosky, 2020, p. 33).

An inflation target policy simply provides a positive rate of inflation over a prolonged, consistent period of time; otherwise known as secular inflation. If keeping in mind the causation definition, rather than the effect definition; as well as the depreciation of purchasing power, we see that a policy of inflation targeting; or secular inflation, leads to a shorter timeframe for the utility of money; i.e., an expiration date of money.

To explain this expiration date, suppose an individual holds £2 in their pocket. Let us assume that this individual; whom we shall call A, holds a marginal propensity to save 0.5 (50%) of every 1 pound he earns, and so will spend £1 and save £1. Under a policy of inflation targeting, the £1 A looks to save will have its value depreciated to 98p in one year, and so in order to hold the same level of purchasing power next year and the same real value of his savings, A must earn an additional 2p per pound by next year. Due to this annual occurrence of a 2% inflation target, in the year after next A will have to earn 4p per pound in order to hold the same real value as two years prior, or risk his money being worth 96p for each pound.

Due to the nature of individual time preference, whereby there is a tendency for people to prefer current consumption over future consumption, A is likely to alter his consumption preferences towards that of current consumption; particularly if he sees the opportunity cost of not consuming today being that of not being able to purchase as much next year, due to a reduction in his moneys real value. This would lead to A’s marginal propensity to save to drop to 0.3 for every 1 pound, and his marginal propensity to consume to rise to 0.7 of every 1 pound.

This ultimately leads to the velocity of money rising and the demand to hold money falling as the excess money circulates, leading to an artificially high level of consumption and a lack of saving, finalising as the effect of inflation: i.e., a general rise in prices. While many Austrians do not view velocity as a useful concept, the velocity of money is simply a measurement of the rate at which money is spent throughout the economy, and it is difficult to logically deny that if velocity were at 0 (no one spends anything), the general price rising effect of inflation would not occur.

What about the aim of price stability? Is it not desirable to have stable prices? The answer is held in the fact that inflation targeting fails when there are large supply shocks such as an increase in productivity; in fact, such price stability measures via inflation targeting provides faulty signals over the value of entrepreneurial endeavours, and masks real productivity gains.

One area central banks look to combat with price stability is deflation; with many under the impression that deflation of all degrees is negative for the economy. A consumer good here or there falling in price being no issue, but all or most goods falling in price, surely must be a sign that the economy is depressed.

In the UK from March 2014 to December 2015, such a consistent fall in prices; both consumer and producer goods, would have surely been seen by the Bank of England as a 22 month period of an economy depressed.

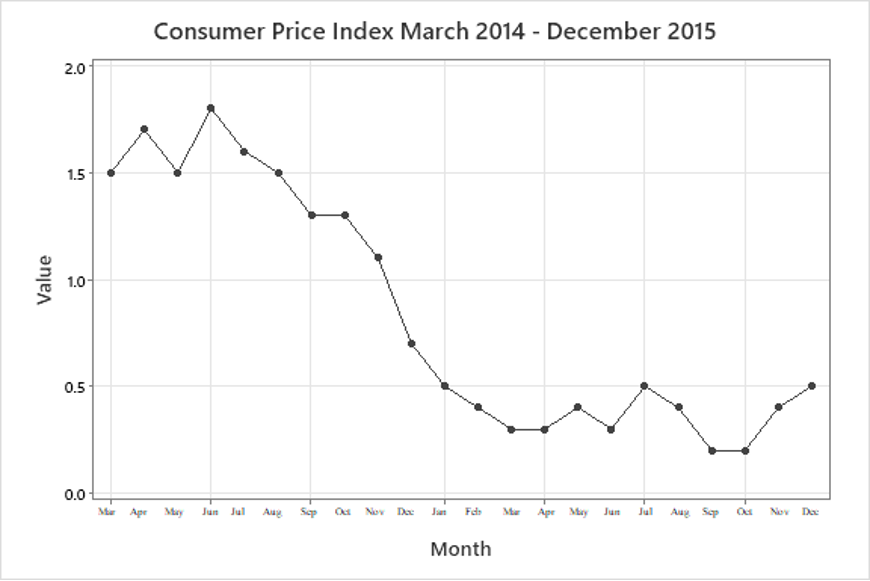

Below shows the consumer price index from March 2014 to December 2015. Over a 22 month period the CPI fell roughly 67%.

OECD (2022), Inflation (CPI)

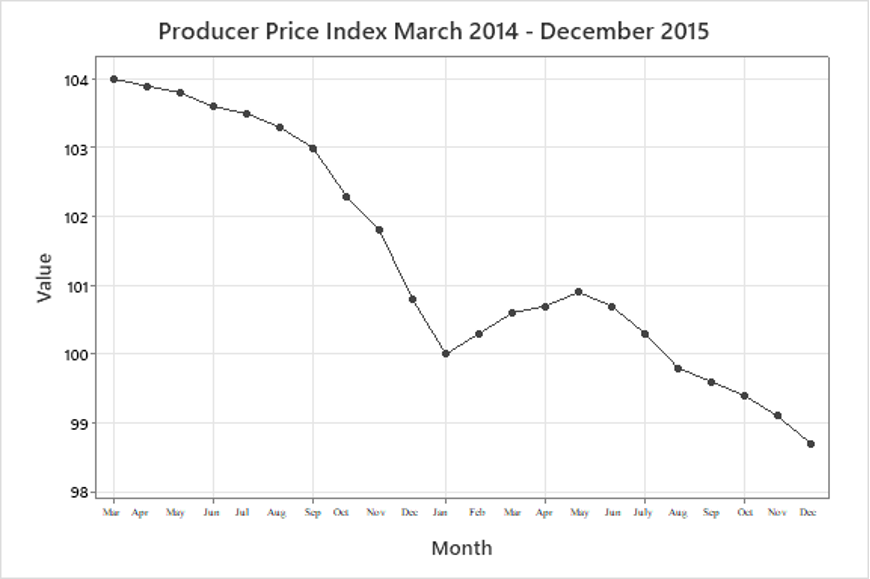

Over the same 22 month period, the producer price index fell by 5%.

OECD (2022), Producer Price Indices (PPI)

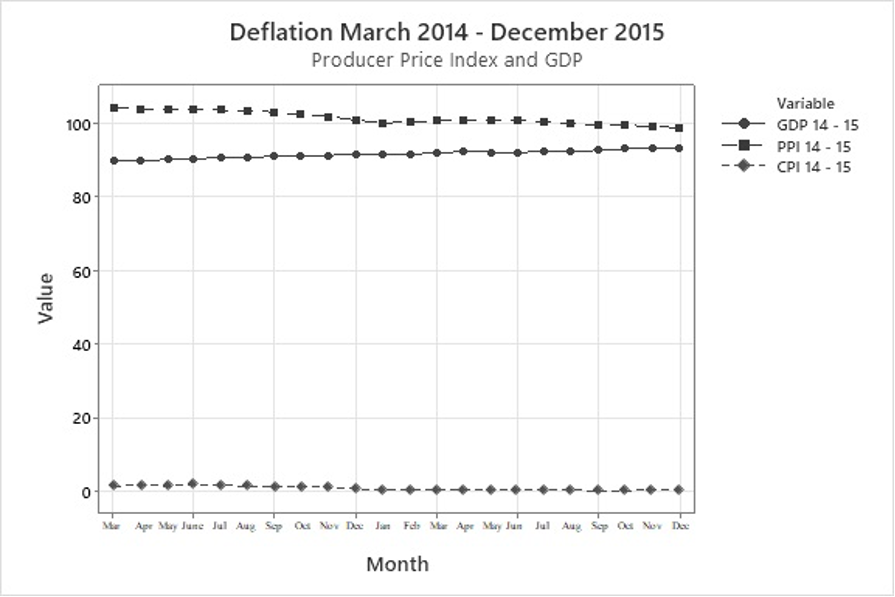

However looking at GDP monthly changes over the same 22 month period, the economy was not depressed, in fact GDP was on a gradual incline.

OECD (2022), Inflation (CPI) – OECD (2022), Producer Price Indices (PPI) – D. Clark (2022), Statista.

The dotted lines represent the progression of CPI, PPI, and GDP. CPI and PPI show a gradual decline, but rather than what should be seen during a depressive episode of falling GDP, the economy was growing.

With inflation targeting and the price stability measures of such policies however, such real changes in productivity have a tendency to be veiled by distorted excess money supplies. By attempting to maintain nominal prices at a stable level, real changes in productivity; both negative and positive, are either dampened down or fully covered.

Price stability and a positive rate of inflation should not be the aims of a monetary authority, as such policies tend to create severe financial instability. Prices should fluctuate to reflect the productivity of individual industries and the economy as a whole, and the efficient (or inefficient) allocation of resources. Instead the monetary authorities should seek to obtain a stable money supply that reflects the demand to hold money, and the inverse of the velocity of transactions.

Such a rule in search of monetary equilibrium and financial stability has existed, unfortunately for the UK, the Peels Act saw an end to that.

Sources:

Bank of England (2022) Inflation and the 2% target. Available at: https://www.bankofengland.co.uk/monetary-policy/inflation (Accessed: 18 December 2022).

- Clark (2022) Monthly index of gross domestic product in the United Kingdom from January 1997 to October 2022. Available at: https://www.statista.com/statistics/1175538/monthly-gdp-uk/ (Accessed: 22 December 2022).

Derby S. (2022) Powell says Fed will not change 2% inflation goal. Available at: https://www.msn.com/en-us/money/markets/powell-says-fed-will-not-change-2-inflation-goal/ar-AA15hZPN (Accessed: 20 December 2022).

Nelson E. (2022) Britain’s Inflation Rate Dips From a Four-Decade High to 10.7 Percent. Available at: https://www.nytimes.com/2022/12/14/business/economy/uk-inflation-prices.html#:~:text=Britain%E2%80%99s%20Inflation%20Rate%20Dips%20From%20a%20Four-Decade%20High,being%20squeezed%20as%20wages%20fail%20to%20keep%20up. (Accessed: 19 December 2022).

OECD (2022) Producer price indices (PPI). Available at: https://data.oecd.org/price/producer-price-indices-ppi.htm (Accessed: 21 December 2022).

OECD (2022) Inflation (CPI). Available at: https://data.oecd.org/price/inflation-cpi.htm#indicator-chart (Accessed: 22 December 2022).

Our Economy (no date) What is inflation? Available at: https://www.ecnmy.org/learn/your-money/central-banks-and-monetary-policy/what-is-inflation/ (Accessed: 20 December 2022).

Walker A (2015) Inflation targeting is 25 years old, but has it worked? Available at: https://www.bbc.co.uk/news/31559074 (Accessed: 19 December 2022).

Wikipedia (2019) Secular inflation. Available at: https://en.wikipedia.org/wiki/Secular_inflation (Accessed: 22 December 2022).