Free Banking Theory and History of the Monetary Sphere

Throughout the history of economic development, banking, and the monetary sphere as a whole, has been the subject of widespread unease to people and a seductive opportunity for Governments. Indeed, there is likely no other institution that has seen such a wide array of Government controls in some form or another; whether that be the formation of central banks, regulations, interventions or monopolisations; all for the purposes, we are told, of maintaining stability and ensuring any economic crises is averted or lessened. This however is not the case. In fact governments’ seizing control over any aspect of money and banking, has seldom been for the purposes of stability or fiscal reasoning.

The purpose of this piece is to demonstrate the theory of what has been coined, Free Banking. Free Banking looks at the theoretical, historical and empirical examples of a money and banking system, free from government control; with private banks setting their own reserve rates, and issuing their own competitive notes.

The piece will go over several key subjects, in order to provide a greater, in depth analysis of the Free Banking theory; with corresponding historical and empirical evidence.

The topics of discussion are:

The Free Banking Theory

-

- Unstable Restrictions and Bad Regulations

- History and Instability of The Bank of England

- Bygone Gold Standard – The Possible Future of Free Banking

The Free Banking Theory

The first and naturally the most important question to answer at this time is, how does free banking operate?

Banks are allowed to issue any liabilities they wish; subject only to the constraint that they persuade their customers to accept them of their own free will. The competition between the banks forces them to make their notes convertible. The banks are compelled to make their notes convertible by persuading a noteholder that it will retain its value; this trust in the stability in the notes value, is achieved by making a legally binding guarantee of the future value of the note. A bank that makes its notes convertible holds a competitive advantage over rival banks that do not have convertibility. Because entry into the competitive market is free (freedom of entry), the banks are unable to form a lasting cartel of inconvertibility; if such an act was tried, it would merely encourage new competitors to enter the market, who would gain an advantage by offering convertible notes, and the cartel banks would lack legal means of privilege and protection to keep the competitor out. Member banks of the cartel would be incentivised to undermine the competition by offering tacit convertibility to noteholders in order to gain an advantage.

In order for a bank to increase the demand of its notes, it would have to expand its attractiveness and trust among customers; advertising more, branching out, increasing its reputation etc. but it could not do so simply by putting more notes out into circulation, when the demand to hold these notes is not there.

This freedom to issue notes competitively, is not without constraint, which is attained via what can been referred to as being similar to a chain gang, and is regulated by market forces.

Kevin Dowd gives details into the restraints banks face and as to why unlimited, undesired expansions of issued notes would not work in the banks favour; stating that:

“Given the fact that banks will choose to commit themselves to convertibility, then it is the need to maintain convertibility which forces banks to limit their note issue. This is so because the circulation of convertible notes is limited by the public demand to hold them. […] Any notes issued beyond the demand to hold them […] would simply be returned for redemption, since the notes would not remain in circulation for long enough to justify the expense of putting them out and taking them back again.”

Banks not just in a free banking system, but in all systems have to guard themselves from two kinds of financial risks: an insolvency risk, and an illiquidity risk. Insolvency is the risk of a bank’s net worth becoming negative, and this kind of risk is one which banks share with all private businesses. Illiquidity is the risk that a bank may default on its legal obligation to redeem its notes or deposits. To protect and attempt to prevent the former, a bank will look to diversify its portfolio, so that fluctuations in asset value are likely to cancel each other out, or be of minimal harm. However, if the bank’s net value is found to be negative, its creditors would run on the bank and shut it down, since said bank is shown to be badly managed with loans not performing, and a risk to its creditor’s capital. When it comes to the latter (illiquidity), the banks could, in principle, operate as “warehouses” in which there is no risk of illiquidity due to operating on a 100% reserve rate. The problem with this though, is the banks would be unable to lend and could only make profits from charging deposit fees. Additionally historical evidence indicates depositors prefer fractional reserve banking due to receiving interest on their deposits; rather than the fees 100% reserve “warehouses” would have to charge its depositors, in order to cover expenses.

Before continuing, an important distinction of the different degrees of money needs to be made:

MOE = Medium of Exchange: Refers to the debt instrument which is transferred in the exchange process (notes). MOA = Medium of Account: Refers to the commodity in terms of units which are quoted as prices (gold) (so many units of good x for one unit of good y). UA = Unit of Account: Refers to those units (MOA). The distinction is important because different considerations apply to MOE and MOA. MOE tends to require the use of an instrument that cannot be used for some other purpose at the same time. A MOA however is free of this limitation and can be used by any number of people simultaneously.

How is the value and quantity of bank-issued money determined under free competition; more specifically, if the banks are subject to no ceiling on currency issue, nor a floor on their reserve ratios, what market forces are in place to compel the banks to limit their issues and hold positive reserves? Assuming gold to be the basic money that acts as the MOA and the MOR (Medium of Redemption), then the purchasing power of money (or MOE) is the purchasing power of gold (PPG); the demand and supply of money determines the PPG; or, the rate of issue relative to the velocity of money or demand to hold determines the purchasing power, which tends to be reflected in prices: MV=PY (money velocity = price of output). The monetary stock demand for gold is the sum of the banks’ demand for reserves, and the demand for bank reserves derives from each bank solving a reserve-holding optimisation problem. In the event of a money shock to supply or demand, the stock quantities supplied and demanded for gold, are represented as:

These are brought back into long-run equilibrium by international flows of gold. This is what the classical Economist David Hume classed as the ‘specie-flow mechanism’.

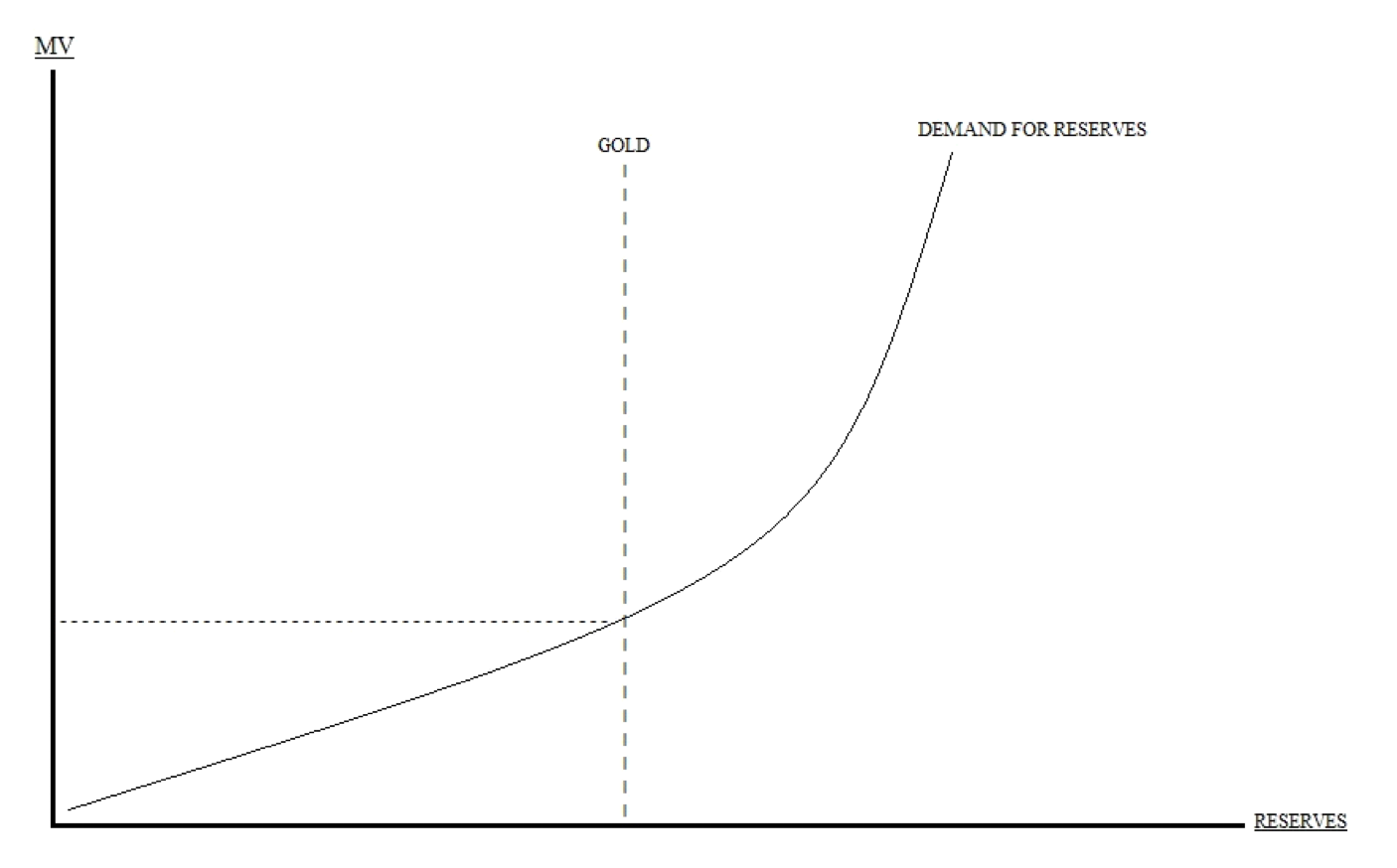

To obtain a greater understanding of long-run equilibrium, we can observe it in diagram format:

The vertical axis represents the banks supply of reserves, with the horizontal representing the banks demand for reserves. The rate of money velocity determines the rate at which the banks hold a demand for reserves; as well as the market rate of interest: for example; if no one spends anything and people are signalling a demand to hold liabilities (notes and deposits) then the bank wouldn’t need reserves and could issue more loans, and transfer larger quantities of credit; the reverse effect takes place if MV is high. If people’s demand for bank liabilities is low and their time preference is for goods sooner, then the banks notes will be returned to them sooner for redemption in gold; meaning the banks will need to hold a higher reserve ratio.

In long-run equilibrium, with PPG being the same worldwide, then the individual country’s share of the world stock of gold; represented as (G i / G w), corresponds to that country’s share of demand for gold-holding on the world scale:

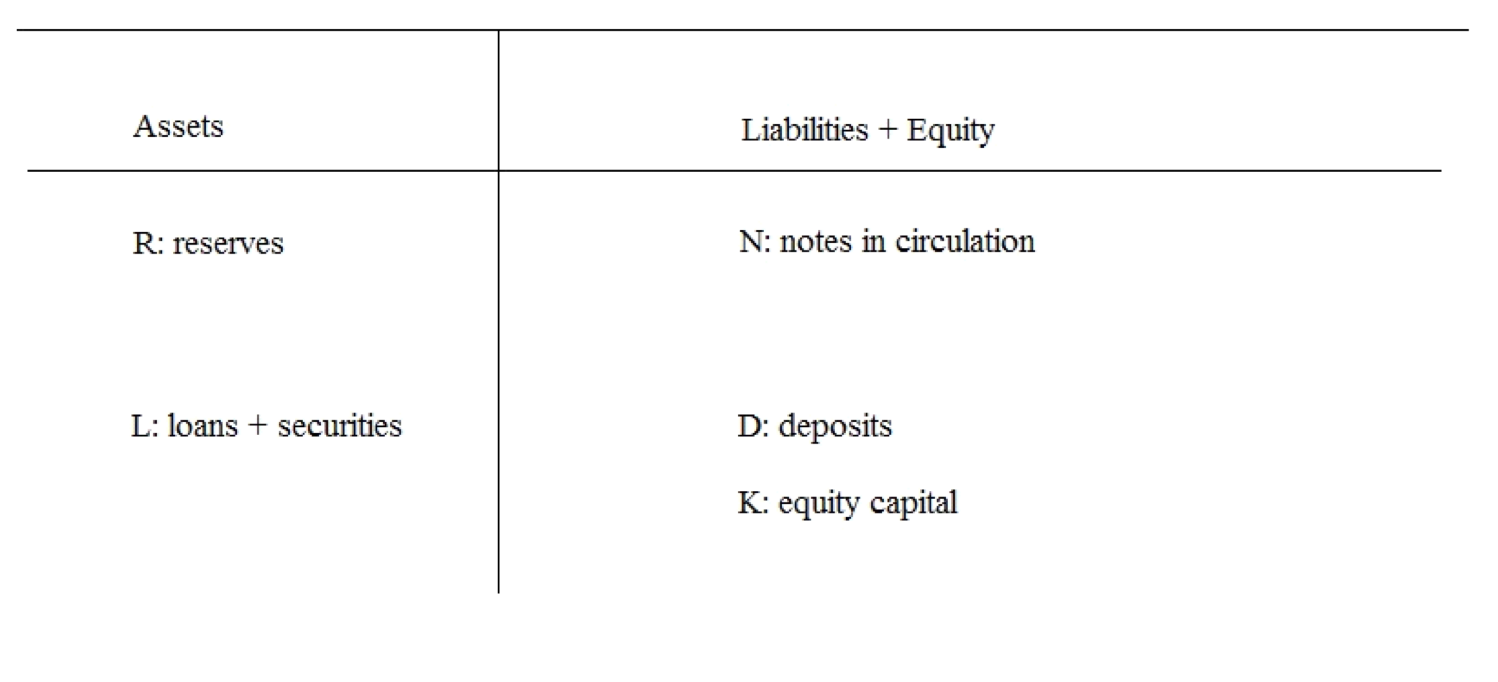

What happens if an individual bank over-issues? Before delving into this important question, we need to take a look at a bank’s balance sheet. This very basic bank balance sheet displays variables for the bank, which seeks to maximise and optimise the total size of each side of the sheet. If we simplify things a bit more and assume K is fixed, then the balance sheet imposes the following constraint:

(R + L = N + D + K).

The banks have an incentive to hold an adequate reserve ratio; not only to enhance profits but to reduce its liquidity cost Q, which is the estimated value of costs incurred in the event the bank runs out of reserves, or reaches negative reserves. The cost of negative reserves may be in the form of legal penalties, the clearinghouse issuing a penalty, or the bank seeking to liquidate its assets in order to cover short notice calls for redemption. The bank’s choice of its level for R and its circulation of N and D, depend on how its choice influences Q. Having a greater volume of N and D circulating raises the number of claims against the bank that can be brought for redemption, and therefore clearings large enough to bring about negative reserves.

There is an equilibrium size of a bank’s currency circulation that satisfies equi-marginal conditions. This is measured by the value of the public’s desire to hold currency issued by the bank i. This value is measured as N i* p, where ‘p’ indicates the public who hold it as an asset, ‘i’ is the issuing bank, and * is the desired value. If the bank’s circulation exceeds the desired level

what would happen? If we assume the excess currency is introduced via loans, the borrower spends the currency; leading to the recipient to have balances of bank i in excess of their desired holdings. The recipient; for which notes issued are greater than notes desired, can respond to this excess in several ways.

(1) Direct Redemption

(2) Deposit Into Another Bank

(3) Spending the Excess.

As a consequence of reserve losses from over-issue, the bank i finds its reserves below its desired ratio, formulated as:

The net benefits of holding reserves now exceed the net revenue from making loans via continued over-issue.

So what of the risks of bank runs? What happens if the banks expansionary endeavours lead to a run? The first thing to note is isolated bank runs are tolerable, because what bad banks lose, better ones gain. Secondly, we need to make a distinction.

There are two kinds of bank runs:

(1) – Deposit Runs: Deposit runs occur when the public runs to convert deposits into notes.

(2) – Note Runs: Note runs occur when note holders run on the bank in order to redeem in specie (gold/silver).

Before we continue we need to define our terms. A deposit is a liability of a bank, which is redeemed with one of the banks liabilities, called a note. A note, is a bank liability that has to be redeemed with an asset, known as specie (commonly gold/silver). A deposit run therefore, is when the public run upon the bank to convert one liability with another; deposits for notes. Note runs then, are runs where the public demands to convert bank liabilities into assets which is an outside medium; or, to put it another way, a medium of redemption that is not a product of the bank such as gold and silver. In the situation of a deposit run, there is a sudden but short demand to convert deposits into notes. This sudden shortage of liquid assets will be reflected in the liquidity market, and will (temporarily) drive up the interest rate. So long as the deposit run does not turn into a note run, the bank could temporarily create extra liquidity simply by issuing more notes. In short, if a deposit run were to occur, the banks would have the incentive to create the necessary liquidity in order to correct it. Note runs on the other hand occur when the public run on the banks to redeem bank notes for specie. Under a fractional reserve system, the banks would be unable to redeem all their notes at once without prior notice; nor is it within the banks abilities to create more specie at will, unlike notes to deal with deposit runs. A single bank may be able to purchase additional specie to cover the redemption, but if the note run is on the banking system as a whole, then all banks will be short of reserves. The banks can avoid the possibility of defaulting on redemptions, by relaxing the convertibility contracts; instead of being bound to redemption on demand without notice, they would use an option clause, giving the banks the option to defer redemption for a pre-specified period of time, so long as they pay a pre-specified rate of interest on the notes which had deferred redemption. It would not be worth suspension if the overnight interest rate is less than the compensation rate the bank would have to pay from deferring. The question then arises: why would the public be willing to have redemption deferred? The noteholders would be compensated if a bank suspended redemption, and the presence of an option clause would reassure risk-averse holders that they would lose little or nothing if they were not first in line during a note run.

An advantage of letting banks issue their own notes, without state-enforced reserve requirements, would be that the banks would be better suited to accommodate changes in the public’s desired currency-deposit ratio, simply by changing the mix of note and deposit liabilities. To give a simple example, let us assume a case, where banknotes alone are used as currency and the desired reserve ratios for notes-deposits are the same; no expansion or contraction would be required of overall money or credit. The stock of base money, ‘B’ is equal to the stock of reserves, ‘R’, while the money stock ‘M’, is equal to that of bank deposits, ‘D’ plus outstanding banknotes, ‘N’.

B = R and M = D + N

Equilibrium here requires that actual bank reserves are equal to the desired bank reserves:

R = r(D + N); where ‘r’ = R/M is the desired bank reserve ratio. By adding ‘B = R’ – ‘R = r(D + N) to subtract D and N gives us: M/B = 1/r. Which indicates the independence of the money multiplier, M/B, from the publics’ desired currency-deposit ratio. Under a central banking system however, all currency takes the form of base money. This means instead of the above mentioned (B = R and M = D + N) we have:

‘B = R + C’ and ‘M = D + C’

Where ‘C’ is the publics’ holding of base money. As commercial bank liabilities don’t include banknotes, the condition for reserve equilibrium is:

R = r(D)

Having c = C/D denotes the publics’ desired currency-deposit ratio, and substituting to subtract D and C gives:

M/B = (1 + c)/(r + c)

The expression in brackets is the standard money multiplier. Unlike a free banking multiplier, the standard under central banking implies that, holding ‘B’ constant, a change in the publics’ desired currency-deposit ratio alters the equilibrium quantity of money. If the public withdraws currency from deposit accounts, then reserves will be drained from the banks, which forces them to contract their balance sheets; unless the central bank expands the monetary base. A centralised, monopoly of currency is then seen to create incentive and epistemic problems seldom present with a decentralised, competitive system.

Under a free banking system, directors of competitive banks have no specific difficulty meeting demands for currency. If a depositor wishes to convert some or all of their balance, the bank need only to supply the depositor with additional notes. If many or all of the banks depositors come forward for the same reason, the bank simply issues further additional notes. The form of liabilities demanded is not a matter of concern for the bank in question, what matter is their total value. When depositors convert deposits into notes or vice versa, there is simply a reduction of one balance sheet item in exchange for an increase in another; this would be similar to changing a £5 note for five £1 coins. As a final point this relates back to what was discussed about deposit runs; a deposit run is a simple action for a bank to deal with, so long as there are no restrictions of note issue in place.

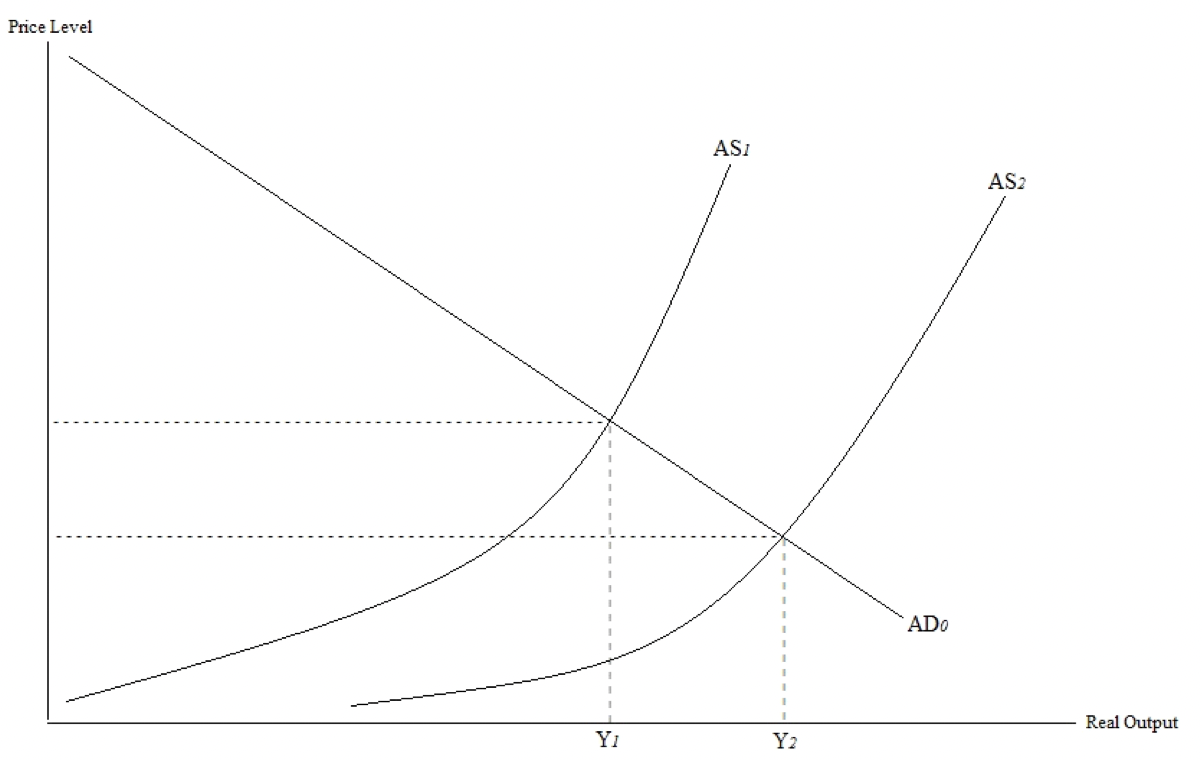

Another way of looking at the calculation problems under central banking can be shown further in two diagrams. We’ll assume two different scenarios; one where central banks operate on a fractional reserve basis, and the other where central banks operate under 100% reserves:

If the central bank holds a monopoly of currency; thereby all the gold stock goes to the central bank and commercial banks treat its IOU’s as their reserves, and it doesn’t back its notes 100% then that spells serious trouble, as when the central bank operates on a fraction it can shift Rs out. As the central bank’s reserve ratio effectively determines the reserve ratios of other banks, this would lead to PY seeing an increase. Where P is the price and Y is output.

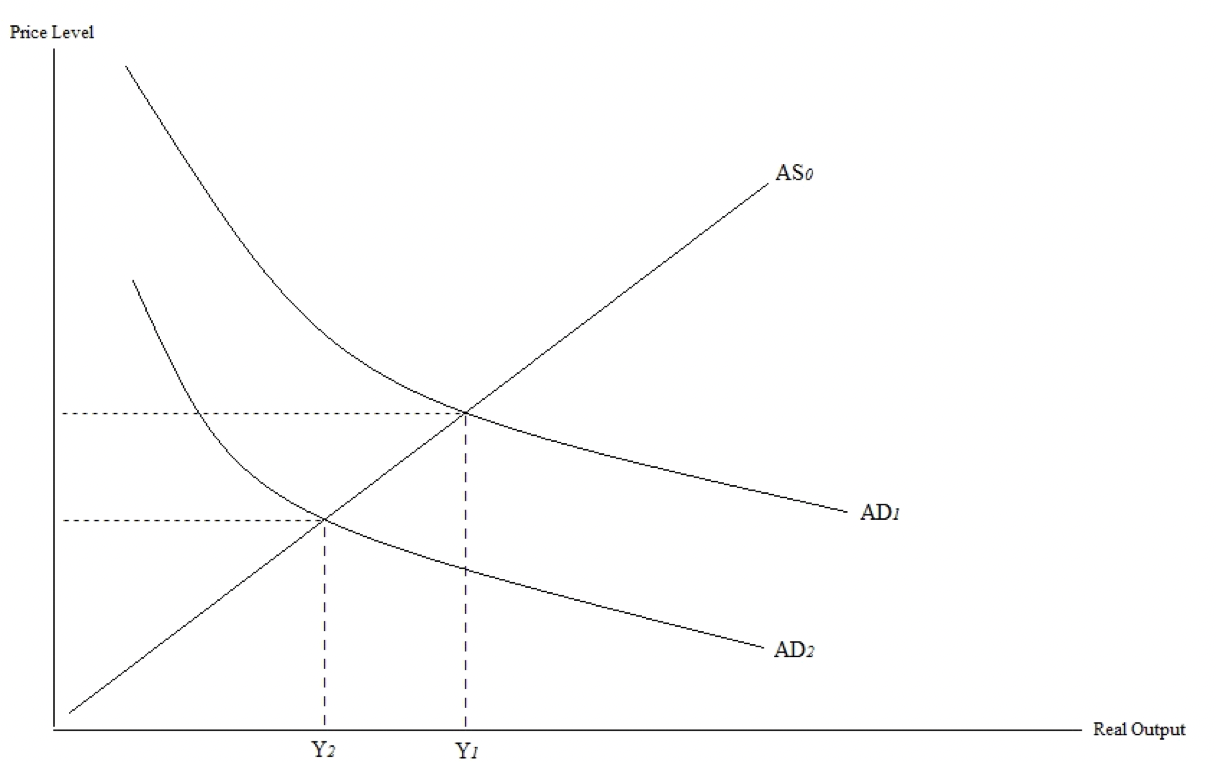

In the second scenario where the central bank operates on a 100% reserve requirement, we can see the effects below:

Under 100% the central bank is forced to issue nominal quantities of notes equal to the quantity of gold in its vaults; the central bank is forced to hold on to its gold reserves. This may seem a better scenario, however, we need to remember that the central banks notes; because it has monopoly of currency, are treated as reserves to the commercial banks. The effects of this are shown in the diagram: If people withdraw more notes, then reserves decline; if they redeposit them, reserves go up; meaning we would obtain instability in the currency ratio, making it still inferior to free banking and the natural, market mechanisms which regulate the banks.

Opponents of Free Banking; or fractional reserve banking in general, base their criticism on two key areas:

The first being the argument that fractional reserve banking is fraud. This argument is focussed on looking at the credit banks issue; viewing it as “created credit”, and that two people cannot hold a claim of ownership to the same coin.

There are two important factors which make the bankers ability to operate on a fractional reserve basis possible. The first is the fungibility of money, which allows depositors to be repaid in coin, bullion or whatever the commodity may be, other than that which was originally handed to the banker. Second is the law of large numbers; which as George Selgin notes, is that which

“ensures a continuing (though perhaps volatile) supply of loanable funds even though single accounts may be withdrawn without advance notice.” (Selgin 1988, p. 20)

The operation of banks classifying deposits of gold in any shape other than an ornament, and acting as savings-investment intermediaries goes back to the days of the goldsmiths. Historically in England, as early as the time of King Charles II (1660-85), the role of the bailee and the debtor of the depositor, developed side by side. This lead to money warehouse receipts becoming IOU notes, or debt instruments. This has been named as the bagging rule. Under this rule coins placed in a sealed bag or container saw the goldsmith treated as a bailee; storing them safely, with a fee charged for storage. On the other hand loose coins brought to the goldsmiths, were acknowledged as loans to the banker; the goldsmith was seen as a debtor, with the depositor holding the right to call upon their loan for repayment. By 1672 the practise of free loans (demand deposits) to the bankers had become widespread.

Since its early development, a fractional reserve bank free from regulation, performs an intermediary role. The bank recognises credit granted to it by depositors/holders of the banks notes, and makes the funds available for loans and investments. As confidence in the demand liabilities of the bank rises, the entire demand for MOE can be performed successfully by them, so all commodity money is withdrawn from circulation and left at the disposal of the bank. Stock equilibrium is reached at the point when the demand for the money commodity for non-monetary purposes (such as bank reserves; industrial/consumption purposes) is sufficient to absorb the surplus created by the use of bank notes. The size of the bank money stock, is determined by the demand to hold bank money at the new equilibrium rate. From this stage onwards, additional expansion of bank money will only appear viable as the aggregate demand for money balances expands. Under a free banking system, historically the banks have continued to demand commodity money for their reserves. This is to maintain a margin of error with regards to the redemption of an individual bank’s notes. Furthermore, banks will regularly send rival bank notes back to the issuer for redemption through the clearinghouse. By returning its rivals notes for redemption, the bank only gives up assets which earn no interest and in return, receive either its own notes (which protects it from unexpected redemption) or it’ll receive commodity money in the form of gold, which is more liquid and a risk-free asset.

On the subject of “created credit” it is agreeable that lending not backed by voluntary savings contributes to instability and financial crises. However, the distinction between transfer credit and created credit helps to illuminate the difference between warranted and unwarranted expansions of the inside money stock. Transfer credit is granted by banks in relation to people’s desire to abstain from current consumption by holding. Created credit on the other hand is generated regardless of any voluntary abstinence of spending. If the nominal supply of inside money is not reduced in tune with a fall in demand for holding money, then the credit is created, rather than transferred. Created credit can only exist in the short run; credit created leads to an adjustment of prices which (eventually) restores monetary equilibrium, causing all outstanding credit to adjust back to the aggregate demand. Since nobody holds inside money in excess of the balance he desires to hold, all credit under monetary equilibrium is transfer credit; meaning any referral to created credit, is the temporary expansion of the money supply due to excess bank lending or investment. Unlike operations of credit transfer, created credit leads to disproportional activities in the production process. This artificial diversion of resources due to the “forced savings” of created credit is halted once prices adjust to eliminate the excess money supply. This expansion and credit creation, is the classic example of the boom-bust cycle; unwarranted expansion, followed by a contraction back to equilibrium. To give a further examination of the difference, credit creation arises when credit granted gives rise to bank liabilities being in excess of the demand for inside money balances. Transfer credit on the other hand, consists of credit granted which gives rise to liabilities in tune and consistent with the demand to hold inside money. It is on this topic that sadly many Austrian Economists fall flat on their theories; including unfortunately Rothbard and Mises. They viewed any credit not backed by 100% as unwarranted, but this would not be a form of credit; any “bank” holding 100% reserves on all its liabilities is not an institution that grants credit, it is merely a warehouse.

Another common argument against Fractional Reserve Banking; besides the “fraud” argument previously discussed with reference to the bagging rule, goes as the following: A warehouse storage on money is legitimate, a time deposit account is legitimate; a demand deposit account is neither a warehouse nor a time deposit. Therefore a demand deposit is illegitimate. This argument however, is based on what is known as fallacy of denying the antecedent, or fallacy of the inverse. It would be on similar lines to saying: a car has wheels and is transport, a bus has wheels and is transport; a train has no wheels, therefore a train is not transport. The difference is not that of kind, but is instead a difference in degree.

In a debate with Economist George Selgin, Robert Murphy makes the claim that it is Fractional Reserve Banking that makes bank runs possible, and that, under a 100% reserve system, bank runs can’t happen. This claim is extremely flawed however, because it looks at the matter backwards; bank runs are seldom unprovoked. This claim holds that banks fail because they are run upon; rather than the banks being run upon because they’re failing. Additionally, this concept insinuates that under a 100% Reserve system, it is not possible for banks to be run upon due to bad loan’s being invested in, poor management by banks of their policyholder’s money, or because of any other criteria which may lead to distrust of the banks. This almost seems like a use of Neo-Classical ‘General Equilibrium Theory’; that under such a banking policy, we must presume the banks to have perfect information and know the costs, desired outcomes, and time preferences of consumers; under such a theory we must presume already achieved states of equilibrium, and for bankers to be omniscient. Such presumptions and already known possibilities, removes the possibility of disequilibrium in the monetary sphere. This seems dishonest, due to the Austrians rejecting the general equilibrium theory of Neo-Classical Economics.

So if it is not fractional reserves which cause instability, cycles or bank panics*, what are the causes?

*A bank panic occurs when a run on the bank liabilities threatens the solvency of the banking system. They’re not only a cause for concern due to threatening the liquidity of the banks; leading to the public questioning the soundness of their medium of exchange, but additionally because they disrupt the information gathering functions of the financial sector. This type of panic raises the cost of credit, though an important distinction to be made is this increase in cost for credit is not accompanied by any increase in incentives to save or to expand credit. The resulting pressure on credit caused by the panic runs a real risk of causing a recession.

There are three schools of thought on banking instability:

(1) – The Bubble Explanation: Instability is caused by bank runs as random phenomena.

(2) – The Incomplete Information: Banking instability is due to bank runs, as rational responses by depositors who are imperfectly informed.

(3) – State Intervention: Suppressing the automatic stabilising mechanisms that evolve in the market; these suppressions can take the form of restrictions of note issue, restrictions of banks as intermediaries, state-mandated liability insurance, using the monetary system to raise revenue, and the lender of last resort.

The bubble explanation sees bank runs as speculative bubbles; underlying a mob psychology. The main characteristic of this, is prophecies are self-fulfilling – any factor that makes people anticipate a panic, will lead to a panic, however irrelevant the factor may be. This theory has the following explanation: (1) banks operate on fractional reserve banking and are unable to redeem all liabilities at once. (2) Banks are obliged to redeem on demand, and do so via a “first come, first serve” basis. (3) The public knows the banks cannot redeem all liabilities, and is concerned to avoid capital losses. As a result, depositors have an incentive to beat runs.

The incomplete information explanation states that bank panics are caused by the depositors’ lack of knowledge of the net worth of banks. This theory suggest that bank runs occur when depositors get noisy signals that suggest the banks are insolvent. The difference between this and the Bubble is that the indicators that cause the panic are relevant economically; they convey information – imperfect as it may be about the state of the banks. In the case of the bubble argument any variable can cause a bank run if it leads to depositors to anticipate a panic. The run of the Incomplete Information theory is “rational”, if relying on it ex-ante. This does not mean the speculation is correct; if it is correct that a bank is insolvent, then the bank run will have served a socially useful purpose by shutting down an insolvent bank. If the speculation is incorrect then it will lead to depositors shutting down a solvent bank.

The regulatory explanation* explains that bank runs are caused by bad regulations of the banking system. The market would protect itself from bank runs if it were unrestricted, and allowed genuine market forces to operate and coordinate, but is prevented and stalled by outside, state-based interference. Free bankers do not deny that a bank may be run upon without state interference, but the theory differs from the other two by denying the banks fail because there are runs; free banking instead recognises the banks are run upon because they’re failing. There is imperfection in information, but free bankers state that these discoordination of signals; as well as most bank runs throughout history, are the cause of interference in the monetary system from the government, as well as the monopoly position and exemption from market restraints of central banks.

*The effects of regulations and central banking on stability and crises will be discussed in detail in the Bad Regulations and Central Banking sections.

On the subject of the history Free Banking holds, many countries throughout history operated on a free banking basis; Canada is the closest contrast to the American system of regulations and national banks prior to the Federal Reserve system; to keep close to Europe, Scotland was arguably the most successful system close to free banking.

The Scottish Free Banking era begins roughly around 1695 by an act of the Scottish Parliament; one year after the creation of the Bank of England. The Act gave the Bank of Scotland a legal monopoly over the issuing of notes and banking activities. While an act of legal monopoly may not seem like Free Banking, the Bank of Scotland thought its position safe; assuming Scotland could not accommodate more than one bank, and took no effort to renew its monopoly position when it expired in 1716.

Though the Bank of Scotland had an official sounding title, it was not treated nor recognised as a state institution. Larry White explains the details of this, stating that:

“The government neither did business with the bank nor regulated it. […] the act creating the bank prohibited its lending to the government, under heavy penalty.” (White 1995, p. 22)

White continues explaining the circumstances which lead to such arrangements:

“The crown of Scotland had been joined to that of England since 1603, and union of the parliaments was soon to in 1707. Shortly after the bank’s founding there would no longer be a Scottish government with which to become entangled. In London the Bank of Scotland was commonly suspected of disloyal Jacobite leanings throughout the early 18th century. The British Parliament therefore turned a deaf ear to the bank’s petitions against the chartering of its first rival, the pointedly named Royal Bank of Scotland, in 1727.” (White 1995, p. 23)

A rivalry between the two banks in Scotland began from day one of the Royal Bank opening for business. The Royal Bank tended to dispatch agents to trade its notes for the notes of The Bank of Scotland, and would present large quantities of them for redemption; with hopes of embarrassing their rival. The Bank of Scotland retaliated in the same manner, but lost the game. It was forced to suspend payment in 1728, due to the continued conflict draining it of its reserves. The bank made calls for its loans to be paid, a 10% call to its shareholders, and resorted to closing its doors for several weeks. This was not a single occurrence however, The Bank of Scotland had already faced suspensions; a run in 1704, which was sparked by rumours of revaluations of coin, forcing it to suspend for four months. While the bank was not insolvent, its assets were illiquid. It was at the time of this run that the bank set an important procedure, by announcing that all notes would be granted a 5% annual interest, which would be in effect during the period of a delay of payment to the bearer. This clause was called again for the eight month suspension in 1715, following a run during the civil unrest, and once more in 1728. During the suspension of 1728, a merger was proposed by the Royal Bank’s directors. However, the two sides were unable to reach an agreement in terms of how to value the Bank of Scotland’s stocks; providing historical evidence of the difficulty of securing a cartel of an industry. The competition between the two banks offered innovation in the banking industry. In 1728, the Royal Bank introduced the cash credit account, which was a form of overdraft. An individual applying for a cash credit account was required to provide evidence of sound character, and at least two co-signatories. Once the account was opened, the holder of the account could draw upon the whole amount or a fraction for personal or business transactions. There was interest charged on the account, but only in the event of an outstanding balance. The CCA lowered the cost of maintaining note circulation for the bank, by introducing more of the public to the use of notes. The account allowed an individual to borrow against his capital at lower costs; allowing him to take on productive endeavours that otherwise would have been unprofitable. The Bank of Scotland followed suit, by introducing their own CCA in 1729. The rivalry between the Royal Bank and Bank of Scotland began to come to an end in the 1740s. In order to counter the popularity of the Royal Bank among merchants in Glasgow, the Bank of Scotland granted a sizable cash advance to a partnership in Glasgow in 1749, for the purpose of forming the Glasgow Ship Bank. The partners promised to promote the circulation of the Bank’s notes. In an attempt to counter the promotion, the Royal Bank sponsored the founding of the Glasgow Arms Bank in 1750. In what was seen as a surprising move to the two banks in Edinburgh, the Ship Bank and Arms Bank began issuing their own notes; leading to the two Edinburgh banks to cease their feud. The Edinburgh banks chose to withdraw their credit from the banks in Glasgow, and stopped credit to any bank in Edinburgh or Glasgow which was circulating Glasgow notes. By 1756 the Glasgow banks proposed a geographical division of the Scottish market between the banks. However, to add more evidence to the difficulty of cartelisation, no agreement could be reached; allowing competition to be maintain in the industry. An important entrant into the banking sector was the British Linen Company. The corporation was chartered in 1746 to promote the linen trade. In 1747, the company’s directors began issuing interest bearing promissory notes, which would be used to pay its agents weavers, manufacturers and other customers. In 1750 it began shifting into the banking sector by issuing non-interest bearing notes payable to the bearer on demand. The Linen Company began to devote its time entirely to banking and withdrew from the linen industry; renaming itself to the British Linen Bank. The bank held a truly innovative role, by being the world’s first success with branch banking. By 1793 the bank had 12 branches in operation, leading to the British Linen Bank having the industries greatest note circulation in 1845. The entrepreneurial efforts of the British Linen Bank; from linen company to bank, showcases the innovative competition achievable under freedom of entry.

An important innovation in banking development, was that of bank-issued notes transferable by endorsement. Assignable notes gave way to fully negotiable banknotes assigned to no one in particular, but instead payable to the bearer on demand. A further development was the non-negotiable check, allowing the depositor to transfer balances to a specific party. Thus, at this time the modern form of inside money; redeemable bearer notes and checkable deposits are established. In England bearer notes were first recognised during the period of Charles II’s reign, it was around this time that warehouse banking was giving way to fractional reserve banking. Initially the courts reluctantly gave approval to the growing practice. Then after some controversy, fully negotiable notes were recognised by an act of Parliament.

While it may be argued no bank would accept a competing bank’s notes at par value, the reality is that banks hold more to gain from accepting foreign notes at par, as both a defensive mechanism to maintain their reserves, but also to attract more customers depositing and conducting business with them. Established banks that refused to take the notes of newly entering banks, or of established rivals soon had to change their policies, since the new banks would accept the established bank’s notes, and would drain their established rivals reserves; providing many an embarrassment for the banks who refused acceptance or par value, while the mentioned established banks were not offsetting their losses, due to not accepting at par. The rivalrous behaviour of banks accepting at par, causes inside money to become more attractive to use over commodity money. This is due to the fact that, since notes from one town are accepted at par value at a bank in another town, there is little reason and is seen as more convenient to carry notes, rather than lugging huge sacks of gold across towns and dealing with the large costs which would come from transporting gold. As George Selgin states:

“As par note acceptance developed during the 19th century in Scotland, Canada, and New England — places where note issue was least restricted — gold virtually disappeared from circulation. In England and in the rest of the United States where banking (and note issue in particular) were less free, considerable amounts of gold remained in circulation.” (Selgin 1988, p. 25)

The notes of Scottish banks, unlike that of Bank of England notes, could be issued into small denominations; though no notes smaller than £1 could be issued under the Act of 1765.

Contrary to the notion, Scottish banks were less at risk to counterfeiting, whereas counterfeiting of Bank of England notes was commonplace, especially in periods of suspension. The reason behind this is that the likelihood of counterfeiting going undetected coincided directly with the length of time a note circulated before being returned for redemption at the issuing bank. Scottish notes on average held a brief time of circulation, as rival banks would not hold the notes of competitors in their tills, but would return them through the clearinghouse for redemption. This was not the case for Bank of England notes, due to restrictions of note issue on banks in London, and the Bank of England’s notes acting as reserves for commercial banks. The six-partner rule as part of the Act of 1708, prevented England from experiencing strong join-stock banks similar to those based in Scotland.

The alarm in February of 1797 that an invasion from France was imminent, accelerated a draining outflow of gold which had already encouraged the Bank of England to restrict its discounts in 1795. This alarm led the Bank of England to suspend payments in specie on its notes. The suspension was approved by Parliament and was not lifted until 1821. While banks in Scotland were mostly exempt from ther drain, when managers received the news that London banks had suspended payment, the managers of the leading banks; the Bank of Scotland, Forbes, Hunter & Co, the Royal Bank and the British Linen Bank, met and came to the conclusion to follow the actions of the Bank of England and suspended payments. The reason for this, was that the Scottish banks feared, if they had made payment in specie available while the Bank of England maintained suspension, the English demand would have drained them of their reserves. It is theorized that the banks continued to quietly redeem their notes in Scotland for specie, handed to them by favoured customers.

The Free Banking era of Scotland came to an end with the passage of the Peel’s Bank Acts of 1844 and 1845. The Act further imposed the privileged monopoly position of the Bank of England, and suppressed freedom of note issue in the countryside, Ireland, and Scotland.

– Unstable Restrictions and Bad Regulations –

We have now shown in detail the history and theory of free banking, but what of an unfree system of money and banking? what are the effects of regulations on the banks?

While it may be argued that the biggest cause of instability are central banks, financial instability is not restricted to central banking. Bad regulations and restrictions can, and do, affect an economies stability.

While England gives a clear example of the instability of central banking, America (which until the Federal Reserve Act has been wrongly classed as free banking) provided clear examples of bad regulations.

While there were various “free banking” laws passed in the US between 1837 and 1861, the classification of these as “free banking” is facetious at best. State laws for “free banking” may have allowed for freer entry into banking, but they required banks to collateralise their notes by lodging them to state government bonds, which in turn tended to fall in value and not be very stable, and so bank portfolios would be stuffed with state bonds not worth their salt. This is in combination to the fact that many state governments restricted branch banking and outlawed notes that gave the issuing bank an option to delay redemption; or an options claws. In short the American “free banking” experience could be summarised as a free entry ticket into quick sand: you can enter for free, but it’s highly volatile with very little benefit.

The United State held two consistent regulations which had a huge effect on its financial instability; one being eluded to above, namely a restriction on branch banking.

Interstate and Intrastate banking laws (Unit Banking) – restrict banks to operate only within the state or county they are chartered; limiting the banks’ economies-of-scale and their ability to branch out; the benefit of not restricting these would be the diversification of capital portfolios to limit the risk of failures, and withstand a crises. American Glass-Steagall Act – The Glass-Steagall Act separated commercial banks from investment banks; prohibiting deposit-based institutions from engaging in investment securities, and investment-based institutions from issuing deposits. It was introduced with the belief that the combination of these institutions was a contributor to the banking collapse of the 1930s, but the restriction actually increases the risk of bank failure, because the banks are restricted in their ability to diversify their portfolios.

Another is that of a restriction on the issuing of bank notes. Restrictions on the note issue are potentially destabilising because they interfere with the mechanisms by which the free market can correct a deposit run; we remember, a deposit run is simply a run for bank notes, not a note run, in which the public is running to redeem their notes for the MOR. A monopoly lender of last resort can be destabilising, because it removes the automatic check on over-issue; the note-clearing system, which would have arisen spontaneously had the note issue not been monopolised and restricted.

Economist Kevin Dowd comments on the increased risk of deposit runs after the American civil war; stating that:

“After the Civil War the note issue was effectively cartelised under the National Banking System and banks of issue were subject to various limits on their note issues. Deposit runs were very frequent but the banks’ ability to deal with them was limited. These runs usually lead to suspensions.” (Dowd 1989, p. 33)

It’s not just regulations which can have negative effects on the monetary system. State interventions, combined with bad regulations, tend to have the effect of inducing instability and bad incentives for maintaining said instability.

State Sponsored Liability Insurance is a perfect example of this. While they protect banks against runs in the short run, in the long run they have the side effect of encouraging policies and bad incentives which are more likely to produce failure, due to the fact that big risk taking banks pay the same premiums as those that pursue safer policies.

The two primary arguments in favour of interventionism in the money and banking sphere are:

(1) Confidence.

(2) Information.

The Confidence Externalities Argument for State Intervention: This argument for state intervention in the monetary sphere takes the basic stance of: Government intervention is necessary to increase insufficient confidence levels that would be provided under a free market in banking. This argument can refer to either a single bank or the banking system as a whole. It runs against the fact the banks, as private establishments have every incentive to promote confidence. Each bank will recognise that, if it does not maintain confidence, it will face greater risk of a run; at beast, forcing it to borrow liquidity, or use its option clause to give it time to liquidate assets to gather the proper funds to meet demands to cash out; at worst, it will be driven out of business. Given this, there is no a priori argument for why a bank will take insufficient measures to promote confidence. Either way if this argument is true it proves too much. If it justifies the suppression of competition within the banking system, then it may justify suppression of competition among other industries which rely on competition; such as insurance, healthcare, broadband, commercial airlines etc.

The Information Externalities Argument for State Intervention: This argument for state intervention states that a competitive banking system would impose large information requirements. It argues that the uniformity of money is a public good, which reduces the information burden; with the conclusion that the government must suppress the varieties of money that would arise under competition. This argument, like the former asks too much, and could apply to any good or service. It can be equally argued against a variety of products or brands. It is simply the argument that too much choice makes life difficult, and should be suppressed by government decree, with the government choosing for its ‘subjects’.

There are many issues for when Governments intervene in the monetary sphere, the two primary issue however are:

(1) The establishment of a central bank to act as a lender of last resort (LLR),

(2) The establishment of state-sponsored deposit insurance.

The LLR role of the central bank – according to proponents – is to provide liquidity to banks who otherwise cannot obtain it. Since the LLR role is meaningless to a good bank; as they can almost always obtain loans to maintain liquidity, LLR protects bad banks from the consequences of their own high-risk investments, over-expansions and lack of confidence from its clients. This leads to central banks encouraging the very instability they claim to be set up to keep under control. It also affects the market in a less obvious manner. Since the LLR role of the monopoly bank tries to keep weaker, less stable banks open, the very existence of LLR reduces the incentives for good banks to build up their customer base, diversifying their portfolio, and generating higher confidence in anticipation of winning the bad banks market share. That competitive aspect of banking relies on weaker, less sound banks facing ruin, and this aspect cannot yield much pay-off if the over aggressive banks are to be bailed out under a LLR. The LLR leads to circumstances where even good banks may act more aggressively in their lending and take more, high-risk investments that weaken the confidence of its client base. As stated above, the irony of the lender of last resort role is it can produce the very instability its proponents claim would otherwise occur without a central bank. The sad reality is, the central banks LLR role could be falsely seen as the cure to financial instability; unfortunately, it often is. Deposit insurance has similar, negative incentive effects. DI leads to depositors being less scrutinising of the banks activities and its management; managers see this and no longer need to worry about maintaining confidence. A rational response from a bank would be to reduce its capital, since one of the main roles of maintaining capital of high strength; to maintain confidence of its depositors, no longer applies. Even if a good bank wished to maintain the high strength of its capital, it would be beaten by bad banks acting on bad incentives who cut their capital ratios to reduce their costs; the fight for shares of the market, would force ex-ante good banks to imitate the bad. State-mandated deposit insurance therefore turns strong capital positions and client confidence, into competitive liabilities and waste.

A final note to make, is on the topic of contagions. Proponents of State involvement look to the nation-wide panic in America during the 1930s. However, these panics were not occurring due to a lack of regulation; on the contrary, they occurred because of regulation and State involvement. The runs which occurred throughout the 30s were due to fears that FDR would devolve the dollar, alongside speculation; prompted by the Governor of Nevada, that the other States would issue bank holidays; if people in one State see another’s governor issuing a bank holiday in which redemption is void, they will begin to speculate and fear similar actions by their own States.

As Economist George Selgin notes:

“Contagion effects also appear to have played a more limited role than is usually supposed during the “Great Contraction” of 1930 to 1933. Prior to 1932, bank runs were confined mainly to banks that were either pre-run insolvent themselves or affiliates of other insolvent firms […] Serious regional contagions erupted in late 1932, but these were aggravated if not triggered by state governments’ policy of declaring bank “holidays” in response to mounting bank failures […] The truly nationwide panic that gripped the nation in the early months of 1933 appears to have been more a run on the dollar than a run on the banking system, triggered by rumors that Roosevelt intended to reduce the dollar’s gold content […].” (Selgin 2015, p. 25)

The combination of reserve requirements, anti-branching laws and restrictions on note issue fostered the panics of America’s National Banking era, as these prevented banks from issuing additional notes to meet growing demand to hold, or effectively mobilising reserves to meet demands; instead these regulations promoted interbank scrambling for base money. Looking at Canada as a contrast to the US; as Scotland was to England, gives us further indication that regulatory restrictions were fundamental in fostering panics, since Canada had a large absence of panics and lacked the restrictions found in the US.

– History and Instability of The Bank of England –

The most malevolent means for a Government to hold control over the monetary sphere, outside of regulations, is through that of a Central Bank. If the United States gives us examples of the instability of regulations and interventions, England gives us an old history of monopolisation and financial instability under central banking. Indeed, the two things which perpetuate State power the most, are financial crises and wars; a Central Bank helps the State in financing the latter and (to give benefit of the doubt; unintentionally) enacting the former.

History shows many examples of governments seeking to use the banking system to raise more revenue. An example of this is in Britain from the period of 1793-1797, in which the government needed funds in order to wage a war with France, so it pressed the Bank of England for loans. These ended up depleting the Bank of its reserves, and when rumours in 1797 of French invasion surfaced, it caused a run on the Bank that it did not have the resources to withstand. This lead the government to stepping in, in order to save the Bank from failure, by relieving it of its obligation to redeem its notes for gold. The early history of the Bank of England can be summed up as a series of purchases of privileges by the Bank from the Government. Originally, the Bank made a loan to the Government of £1,200,000 for William III’s war with France, in return for the right to issue notes to the same amount. This fixed amount was extended in 1697, when it was argued that the Bank should enjoy a monopoly of chartered Banking in England, and the privilege of limited liability for its shareholders.

This privilege is expanded on by Economist Kevin Dowd. Dowd comments on the privilege over monopoly of note issue; stating that:

“[An] example of destabilising restrictions on the monopoly note issue is provided in the 1844 Bank Charter Act in the UK. This act gave the Bank of England an effective monopoly of the note issue, but it also divided the Bank into an Issue Department (responsible for the note issue) and a Banking Department (responsible for the rest of the Bank’s business), and these two departments were to be entirely separate from each other. […] The effect was to leave the Bank wide open to deposit runs since the Banking Department had no access to additional notes (or specie, for that matter) if it were faced with a run on its deposits. This created the absurd possibility that the Bank of England might default on its obligations to redeem its liabilities despite the fact that the vaults of the Issue Department were full of gold. Three times subsequently – 1847, 1857 and 1866 – the Bank was faced with such runs […].” (Dowd 1989, pp. 32-33)

In order to obtain proper context of the Bank of England, we require going back ex-ante its establishment, as well as ex-post its monopoly roots reaching into the core of money and banking.

The origin of modern banking can be traced back to around the middle of the 17th century, when merchants took up depositing their MOE with goldsmiths. In order to expand their operations, the goldsmiths began offering interest on deposits; the receipts they issued out for deposits would begin to circulate as a good alternative to lugging around heavy bags of bullion; this is what would lead to the paper receipts becoming IOU’s, or debt-instruments. Banking development took a change towards more centralised and monopolised methods around 1694, by events of purely political nature. King Charles II had run himself into considerable debt via relying on loans from the London Bankers, and 1672 Charles II suspended payments, and the repayments of bankers advances. This caused the King’s credit to be thereby ruined for several decades. This lead to William III and his Government to follow the scheme of a financier, named Patterson for the founding of an institution known as the Governor and Company of the Bank of England; later to be known as it is today as simply the Bank of England. The early period of the Bank of England’s origin was summarised by a series of exchanges of favours between a needy government and a corporation more than happy to accommodate. The BoE was founded with a capital accumulation amounting to £1,200,000, which was immediately lent to the government; in return, the BoE was authorised to issue notes of the same amount. In 1697 the government renewed the BoE’s charter, along with extended privileges; allowing it to increase its capital stock, and thereby its note issue, in addition to providing it the monopoly possession of government balances, via the order that all sums due to the government (taxes), must be paid through the BoE. Furthermore, a clause in the Tunnage Act provided limited liability to the members; this favour was to be denied to all other banking associations for over a century, giving the monopoly bank not only a great degree of privilege, but a “head-start”. Further grounding in the BoE’s monopoly and privilege was established in 1709 when the Bank’s charter was renewed once more. In addition to allowing it to raise its capital in return for a loan to the government, the Act decreed that no firms of more than six partners may issue notes payable on demand less than six months; this decree excluded joint stock banks from issuing their own notes. There were further renewals of the BoE’s charter which reaffirmed its privileges, accompanied loans and increase in capital and note issue in 1713, 1742, 1751, 1764, 1781 and 1800. To put it briefly, the Treasury had benefitted from the BoE’s monopoly position no less than seven times. Soon after the French war broke out, Pitt requested advances from the BoE. However, the 1694 Act had prohibited advances to the government without direct authorisation from Parliament; though for many years small amounts had been advanced on Treasury Bills made payable at the Bank. In 1793 the BoE applied to the government to indemnify it against liability of loans made in the past, and give it legal authority to carry out transactions in the future. Pitt agreed to bring the Bill to Parliament, but conveniently left out a limiting clause, leading to the Bank becoming compelled to complying with government requirements of any amount. By the period of 1795, these borrowings had reached such an excess that it affected the foreign exchanges, and endangered the BoE’s reserves; leading to the Bank’s directors to plead with the government to keep its demands down. Finally, in 1844, an Act was passed which ensured the Bank of England held monopoly of the issuing of notes in the country.

Many proponents of central banking would point to the British journalist and essayist Walter Bagehot and his famous book Lombard Street as argument for the existence of the Bank of England; stating that Bagehot called the Bank’s primary responsibility to be a lender of last resort, in order to ensure financial stability.

The problem with such an argument is that Bagehot’s call for the Bank to operate as a LOLR, was not out of belief that a central bank is necessary, but because he saw it as the only viable option to ensure the Bank of England performed as little damage as possible; that if a nation finds itself stuck with a monopoly bank of currency, it is to act in this way but that nations should not aim to establish such a bank in the first place.

We can see proof of this, anti-central bank position by simply reading straight from the source:

“In consequence all our credit system depends on the Bank of England for its security. On the wisdom of the directors of that one Joint Stock Company, it depends whether England shall be solvent or insolvent. This may seem too strong, but it is not. All banks depend on the Bank of England, and all merchants depend on some banker.” (Bagehot 2009, pp. 19-20)

Bagehot continues by stating that:

“The result is that we have placed the exclusive custody of our entire banking reserve in the hands of a single board of directors not particularly trained for the duty – who might be called ‘amateurs’, who have no particular interest above other people in keeping it undiminished – who acknowledge no obligation to keep it undiminished who have never been told by any great statesman or public authority that they are so to keep it or that they have anything to do with it who are named by and are agents for a proprietary which would have a greater income if it was diminished, who do not fear, and who need not fear, ruin even if it were all gone and wasted.” (Bagehot 2009, pp. 22-23)

“We are so accustomed to a system of banking, dependent for its cardinal function on a single bank, that we can hardly conceive of any other. But the natural system – that which would have sprung up if Government had let banking alone – is that of many banks of equal or not altogether unequal size.” (Bagehot 2009, p. 33)

Here Bagehot makes the remark on not returning to a system of competing banks of issue; not due to the superiority of the Bank of England, but due to the belief that no one would listen to him if such a call was made, as well as how the Bank should behave as a second best to it not existing at all:

“On this account, I do not suggest that we should return to a natural or many-reserve system of banking. I should only incur useless ridicule if I did suggest it.” (Bagehot 2009, p. 34)

“I can only propose […]. There should be a clear understanding between the Bank and the public that, since the Bank hold out ultimate banking reserve, they will recognise and act on the obligations which this implies; that they will replenish it in times of foreign demand as fully, and lend it in times of internal panic as freely and readily, as plain principles of banking require.” (Bagehot 2009, p. 35)

Walter Bagehot makes his final remarks here on how impossible it seemed to do away with the Bank of England; equating it to being easier to imagine the abolition of the Monarchy:

“I have tediously insisted that the natural system of banking is that of many banks keeping their own cash reserve, with the penalty of failure before them if they neglect it. I have shown that our system is that of a single bank keeping the whole reserve under no effectual penalty of failure. And yet I propose to retain that system […] I can only reply that I propose to retain this system because I am quite sure that it is of no manner of use proposing to alter it […] You might as well, or better, try to alter the English monarchy and substitute a republic, as to alter the present constitution of the English money market, founded on the Bank of England, and substitute for it a system in which each bank shall keep its own reserve.” (Bagehot 2009, p. 144)

If one were to look at the shaky ground the English Monarchy has found itself in recent years with questions about its future, it can only be hoped that the British public will soon begin to question the validity of the Bank of England.

History shows not only the financial crises and major restrictions of regulations mentioned previously, but also those of central banking.

Below we see a historical record of financial crises and major restriction from the period of 1793 – 1933; the record shows America and England with their free banking counterparts, Scotland and Canada. An x indicates a crises for that period, and a black square indicates major restrictions enacted.

Source: George Selgin 2015, pp. 196-197 [condensed]. In reference to Bordo “Financial Crises”, Schuler “World History”, Schwartz “Financial Stability”.

Here we can see that the systems of high regulations, restrictions and monopoly of currency far out-performed for the grand prize of most crises riddled system than their free banking counterparts; not a good achievement to say the least, but an achievement none the less.

Under a central monopoly bank of issue system, as opposed to a free banking system of competitive note issue, things are radically different, due to the monopoly bank’s notes acting as reserves for the commercial banks, with the commercial banks issuing central bank notes, and are prohibited from issuing their own. In order to pay out notes to customers, a bank must acquire the notes in the interbank market, or from the bank of issue. If no additional notes are made available, then reserves become deficient and the banks must perform a contraction of their liabilities to avoid a default. In this scenario the supply of loanable funds is constrained, and lending rates rise above equilibrium, which then leads to a scarcity of credit, despite individuals’ demand to hold having seen no change. If the monopoly bank provides the desired reserves then a credit shortage is prevented. However, there is no certainty that the central bank will cooperate. Even if said central bank were to do so, there is no certainty that the notes issued for emergency purposes will be retired once the public no longer demands them. Unless such a precaution is taken, the surplus notes could return to the deposit banks, leading to them serving as the basis for inflationary expansion of bank credit.

Negative effects of central banking continue into the realm of deflation. In economics there is a distinction between good deflation and bad deflation.

Good deflation occurs due to an increase of productivity and reduced cost of production; leading to supply shifting to the right, and prices falling. This kind of deflation has a tendency to be relative; meaning certain industries such as computers, cars, crops or (in a parallel universe for Britain) housing.

However most central bankers don’t (or can’t) make the distinction between good and bad deflation.

A shortage in the money supply below that demanded, will lead to deflation; with reduced sales leading to production cutbacks in certain sectors, followed by reduced demand for the products of other sectors and finally to general unemployment. This is the bad kind of deflation which is not caused by productivity; either in a particular sector or the economy as a whole. Unfortunately, central bankers persist in regarding all deflation as the bad kind.

To add further setback to the general understanding of deflation, many Austrian Economists* persist in insisting that there is no such thing as bad deflation, and that all deflation is good. This perspective very much comes across as merely contrarianism; simply looking at the central bank’s view of deflation and frantically insisting on the opposite as a fact, when in reality the fact is based on a difference of degree.

In addition to what can be classed as “Young Austrians” and “Rothbard Fans” rather than readers.

What is the method to the madness? Why and how does the government benefit from a central monopoly bank of currency? For an answer we need to look at Siegniorage.

Siegniorage is the concept that governments reap the profits from producing new money at an expense less than the value of the money produced. The government is then able to finance additional expenditure by spending the new money into circulation. If the new money is interchangeable with the old, then an expansion of the stock of money taxes money holders by reducing the value of already established money balances (i.e. inflation). Under a specie standard of gold or silver, siegniorage was the differing value of minted coins and the actual content of gold/silver in them. This minting process, algebraically was subject to the following accounting identity:

M = PQ + C + S.

Where ‘M’ is the nominal value assigned to a batch of coins (e.g 100 pounds) ‘P’ is the nominal price paid by the mint per ounce, ‘Q’ is the number of ounces of precious metals embodied in the coins, ‘C’ is the remaining average cost of operating the mint, ‘S’ is the nominal siegniorage.

Modern banking and monetary systems do not operate under a specie system though, so how does siegniorage operate under a fiat system? Since the bullion content is 0 and production costs are close to 0, we need to set Q as Q=0; to further simplify we’ll set C as C=0. This follows that M=S. Nominal siegniorage equals one pound for each pound produced. Therefore a government’s siegniorage per year is equal to the change in the money stock. This can be written as:

S = ^H

Where ^ (delta in Greek) indicates the change in H, which is the stock of base money. Real siegniorage is marked as:

s = ^H/P

Where the lower case represents deflated variables, and P is the price index.

The budget constraint for a government that issues fiat money is:

G = T + ^D + ^H

Where G is government spending and T is tax revenue. ^D is the change in interest-bearing debt held by the public and not government. ^H is the change in non-interest-bearing debt (base money) held by the public.

The financing benefits to government via siegniorage is obvious when it comes to the mere printing of money. Via the method of open market operations, the method is a bit more indirect. By purchasing ^H worth of bills in the open market, the central bank retires that much debt; with the interest going to the central bank, and makes it possible for the treasury to finance a host of new streams of spending, whose current value is equal to ^H. In order to conduct the new spending in the current period, the treasury sells new debt to the public, replacing the debt which the central bank bought. The central bank’s open market purchase expands H and contracts D. The treasury’s issue of new debt sees D rise back up, followed by a rise in G. The overall impact is an increase in G financed by ^H; just as if the central bank had simply printed new currency and given it to the government to spend.

Vera Smith sums up the potential of central banks for governments in a statement from her book The Rationale of Central Banking:

“[…] it must be admitted that it is almost certain that by far the most powerful reason leading to the maintenance of Government intervention in the banking sphere, at a time when it was on the decline in other industries, was that power over the issue of paper money, whether such power is direct or indirect, is an exceedingly welcome weapon in the armoury of State finance.” (Smith 1990, p. 9)

– Bygone Gold Standard – The Possible Future of Free Banking –

As the final section I wish to present to the reader the following hypothesis:

Many supporters of free banking have suggested we would require returning to a gold standard, or keep a small remnant of the central bank if we retain a irredeemable fiat system.

The argument mentioned above goes along these lines:

If we were to return to a free banking system of competitive banks issuing their own notes, we would have to return to a gold standard in order to have the currency anchored to something. Irredeemable IOU’s would provide too much risk for financial instability. If we cannot return to a gold standard, then in order to have something like a free banking system, we would have to keep some degree of central banking, but get rid of the discretionary power to manage the monetary standard.

I propose that thanks to the technological developments of the past 10 years, a return to the bygone gold standard is not necessary; nor is maintaining a remnant of a central bank of monopoly issue.

The proposal goes as follows:

Maintaining the MOA and UA as pound sterling, the fiat system should be converted to a crypto format of pound sterling, with scarcity artificially built and coded into the outside money and MOR. The new crypto-based outside money and MOR, would be obtained alongside the banks issuing their own debt instrument; IOU’s on a fractional reserve, with no floor restriction on how small denominations may be, with redeemability of the crypto MOR being transferred to a customer’s private wallet should they call upon the bank to pay the bearer on demand; an option clause would remain in place with interest to be pay of 5% should the bank require time to redeem.

It may be argued that such a proposal is not needed, because we have Bitcoin.

While I am a fan of Bitcoin I don’t think it is up to the task, due to its high volatility, and because I don’t think Bitcoin maximalists actually know what they want it to be when they say “Bitcoin can be the new money”.

The typical counter from Bitcoin maximalists on the subject of volatility is “if you think Bitcoin is volatile you should see the fiat money. What about that? Why not criticise government money?”

My response would be simply I have criticised State centralised, monopolised, irredeemable money throughout this piece, and this argument is simply Whataboutism; a variant of the tu quoque fallacy. The response to criticism of volatility being “look what the other guy’s doing” is not an argument nor a solution.

On the point of Maximalists not knowing what they want, I refer to the case that, the demographic in question tend to not make a distinction and other times will blend terms together.

“We need a Bitcoin standard” Well this a loaded statement. What is meant by it? Are we looking at Bitcoin as a future medium of exchange, medium of account, unit of account, medium of redemption, or a blend? If we are looking at Bitcoin being a MOE, then it would simply act as a base money with the UA remaining as pounds, dollars etc. If we are looking at it being a MOA, then we are going to have some extortionately high costs. It’s not cheap or of no cost to change the account medium or the unit; excessively large amounts of time would be the price for accounting how much x quantity of a good is worth of y unit; it would not be a simple difference of “2+2=4” and changing it to “2×2=4”, it would be as if creating an entirely new number; the time and costs of figuring out what is less, what is more, and what it equals when correlated with other numbers.

This does not mean Bitcoin or any other cryptocurrency cannot or should not play a role in the proposal. It is entirely possible that an individual bank could issue Bitcoin as an alternative medium of redemption, should it find itself unable to redeem in crypto pounds.

To get back to the matter, what of the banks’ individual debt instruments? Crypto is entirely digital so how would banks issue IOU’s?

in the crypto sphere there is what is known as paper wallets. These are essentially slips of paper with QR codes which keeps track of the currency a person holds, which can be redeemed into their private wallets via scanning the QR code.

Bank IOU’s would function in a similar manner to that of paper wallets, and the debt instruments issued by various banks during the Scottish free banking area.

Above we see some basic designs to provide an idea for how these bank IOU, “paper wallets” could be presented.

The banks would issue debt instruments with their logos printed on to the slips to better advertise their services in the hopes of raising demand for their notes; just as banks in a free banking system would do. These notes would be issued to customers after making a deposit of crypto pound sterling (from this point we’ll refer to it as CPS); unless the account created is a time deposit, the deposit will be treated as a loan to the bank, with the bearer having the right to call upon the bank for redemption and for the bank to make payment upon its debts. This method of redemption would function on the same grounds as it does with paper wallets in the crypto sphere. When the debt instrument is brought for redemption, the QR code will be scanned and the CPS electronically transferred to a customer’s private wallet.

When it comes to the velocity of the bank notes, the transferring of notes would work the same way it does today and during the Scottish free banking era. Notes used for financial exchanges, after the settlement is made, can be deposited at the recipient’s bank, spent further, or redeemed at the bank of issue for CPS.

If an individual bank were to over expand beyond the demand to hold its notes, the same equation mentioned previously would occur:

Leading to the same outcome when over issued notes are brought for redemption by the public, or at the clearinghouse:

What about coins? There are many instances where small change is needed for transactions, would small denominations of coins remain or would the smallest be notes of £1?

To answer simply, yes denominations smaller than £1 would remain; in either the form of coin or, if an individual bank’s customers held a demand for smaller denominations but held a preference for notes, the bank could issue notes of 50 pence, 20 pence, 10 pence etc.

We’ll assume a similar case to that of our current one with the exception of £1 notes existing.

Denominations smaller than £1 would be conducted as minted coins, tow which either the banks would mint their own with the ability of redemption in small denominations of CPS (or small “p” for crypto pence; Cp), or independent minters would provide said coins for circulation; similar to what occurred with the Birmingham Button Mints.

These coins would not necessarily have to be minted from silver but could be simple plastic tokens as, the material they’re made from would not be of great importance.

These coins, like the notes displayed above, would hold a QR code raised on the coins similar to that of braille. When used in a machine for payment such as parking, the raised QR code would be scanned to assess what denominations are being entered; alongside ensuring the braille-like QR code is unique to the denomination in question and is not a counterfeit.

Depositing the small coins and redemption would work the same way as the notes. The code would be scanned and the MOR would be transferred to the customer’s private wallet; in the case of depositing into the bank, it would be managed in the same manner with the balance being issued and credited to the customer’s account.

Who would “mine” the CPS?

Banks themselves would not mine for the CPS, this venture would be handled by private coders being commissioned to produce the CPS; receiving a percentage as payment based on hash rate and proof of work, as is similar to how miners are compensated in the crypto sphere. It is unlikely banks would find an attraction to mining themselves, due to the difficulty of obtaining results the closer a cryptocurrency reaches its scarce limit, as well as the costs of maintaining their own resources for mining and coding, due to requiring high powered technology for efficient hash rates. It is therefore more plausible that the banks and minters would find it more efficient to shop around; find high quality miners who have good track records and contract them for their work and offer a percentage of the coins mined as compensation.

– Final Thoughts –

While this proposal is a short one and more work is certainly needed to expand further details, it should be clear that cryptocurrency technology offers a viable method of abolition central banking without reinstituting a bygone gold standard. We have the technology, we know it’s possible to encrypt scarcity into cryptocurrencies, and it does not require the high costs and delays of changing the MOA or UA. Under such a system it is more likely and probable of getting government out of money and banking; learning from the more free systems of the past, and developing a more private, competitive and free monetary system.

– Sources –

Dowd, K 1989, The State and the Monetary System, St. Martin’s Press, New York (pp. 8-9)